The Central Bank of Cuba is providing important information to its clients today

On March 15, the authorities of the Central Bank of Cuba (BCC) provided important information to its clients on the island, regarding the issue of online payments and the non-compliance of many institutions with the establishment of so-called “banking services”. We're telling you.

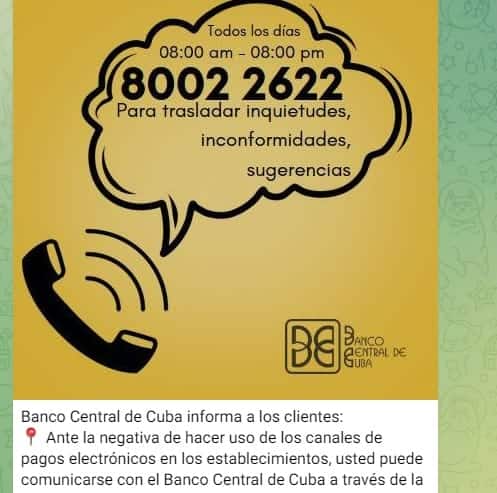

As is common among many banks, such as the Metropolitan Bank of Havana, which has more than a million customers in the Cuban capital, the Central Bank of Cuba has informed customers of the following contact information to file complaints.

“before Refusing to use electronic payment channels in establishments, you can contact the Central Bank Cuba through the Bienestar platform and raise your complaint.

In addition, you can report your concerns, disagreements and suggestions about Process B.ancarization Everything related to the national banking and financial system networks.

In addition, they offered a phone number, 8002 2622, to convey these concerns and complaints of establishments that do not accept payment via QR, etc. They added that they answer this phone from 8:00 a.m. to 8:00 p.m. “We are here to serve you!” They insist.

More information from the Central Bank of Cuba

The Central Bank of Cuba recently celebrated the six-month anniversary of the implementation of the banking operation on the island and provided some information on its results.

This is a shift in which all transactions (the vast majority of them), from payments for services and products to commercial and financial operations, are carried out digitally. Cash is being replaced by electronic payment instruments and channels, streamlining and simplifying money management.

Globally, large transactions are no longer carried out in cash, but using electronic payment instruments. Therefore, Cuba is not innovating in this process. Ultimately, it will only adapt to current international standards and practices.

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/SXDWOIO7O5FMZOWUATFEXQYWTY.jpg)

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/XZZ7RF3MBZBKXFMMC4MCEZSVWM.jpg)

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/Z7S52JIDDZDG7EOKJQ34AFAU4I.jpg)