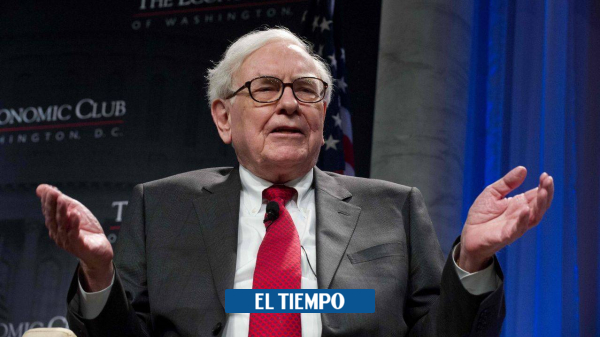

At the age of 91, crowded buffet Boosted an important cart in the business sector. This has led to him being the sixth richest man in the world, according to ‘Forbes’, and the founder of Berkshire Hathaway, a group with shares in famous companies such as American Express, Coca Cola, Tesco and others.

If I lose money to the company, I’ll be understanding. If I lose the company’s reputation, I’ll be tough

buffet It has also become a reference in financial and economic consultancy. So much so that it is known as the “Oracle of Omaha”.

He has an iconic phrase, according to him, that led him to success: “It takes 20 years to build a good reputation and five minutes to destroy it. If you think about it, you’ll do things differently“.

His teachings, according to his column in the “Inc” medium, will allow people to move with greater caution. “If you lose money to the company, I will understand. If you lose a little reputation For the company, I will be tough, ”says the billionaire.

Buffett defines reputation as “a priceless asset that must be protected every day.” For him, this is a way to measure success, although it is fragile and can be lost in minutes.

Now, to preserve it, the employer recommends not to risk integrity. That is, stay true to yourself and act according to your values and principles.

“We look for three things when we hire people. We look for intelligence, we look for initiative or energy and we look for integrity. And if you don’t have the latter, the first two will kill you, because if you’re going to get someone with no integrity, you want them to be lazy and an idiot.”

(Read also: Bill Gates’ keys to reaching the “end” of the epidemic).

For him, it is much better to put trust in those people who act with character and integrity because that provides security about their decisions and behaviors.

Finally, Buffett left an important tip for his readers: “Be considerate and respectful of the way your decisions affect others and take every opportunity to add value to those you serve.”

Buffett owns about a sixth Berkshire Hathaway, the company he took over in 1965 and has grown into a giant conglomerate with dozens of companies and a huge investment portfolio.

In recent months, Berkshire Hathaway’s accounts have benefited from the good performance of the markets and, in particular, from the value gained by its extensive investments in companies such as Apple.

He currently has a fortune of over $100 billion.

More news

Bill Gates Scholarships: Open Enrollment to Study in Cambridge

These billionaires in the world have lost everything

Six golden rules for being rich, according to a millionaire

How do you become rich? These are the keys to famous magnate Warren Buffett

weather trends