Thanks to the advent and rise of social media, many people have been able to become well-known and even though…

3 Quinta de los Molinos Open Space, a center based on the field of culture, tourism and sports, celebrates World…

Denver Nuggets He is the clear favorite to win the series Playoffs in view of los angeles lakers, Because they…

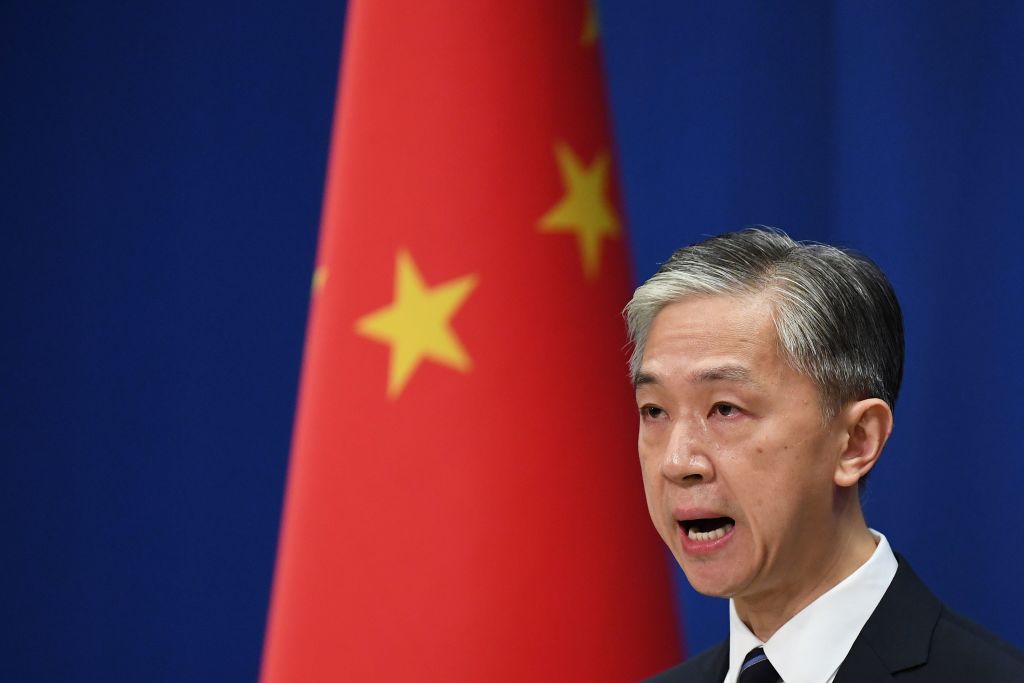

(CNN in Spanish) — China and Argentina are “comprehensive strategic partners,” Chinese Foreign Ministry spokesman Wang Wenbin said at a…

Edmundo Gonzalez Urrutia Edmundo Gonzalez Urrutia He has been an unknown celebrity for the Venezuelan opposition's presidential candidate: a diplomat…

Random number generators (RNGs) are the unsung heroes behind many business processes. But, what are they commonly used for? Let’s…

Betplay League After the solutions in the administrative part, the restructuring of employees will now begin. Santa Fe vs Atletico…

Nicolas Maduro's regime has barred five other dissidents from holding public office the Comptroller General Of Venezuela, Controlled by Nicolas…

(CNN) — The Pentagon said on Wednesday that the United States earlier this month delivered long-range missiles to Ukraine that…

:quality(70):focal(917x454:927x464)/cloudfront-us-east-1.images.arcpublishing.com/elfinanciero/IK6YWCPEYFBRRFEKOPGFRQXC54.jpg)

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/47SKHC5YNBDENPZADEVC644MBE.jpg)

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/VWWQ37HV5ZERLPFWQKUG6JD2CQ.jpg)