They predict the historic collapse of Russia

(Bloomberg) — Analysts at JPMorgan Chase are starting to think Increasing unrest in Russian exportsThe latest damage toll from US banking sanctions shows that the “collapse” of the economy could be similar to the consequences of the country’s 1998 default.

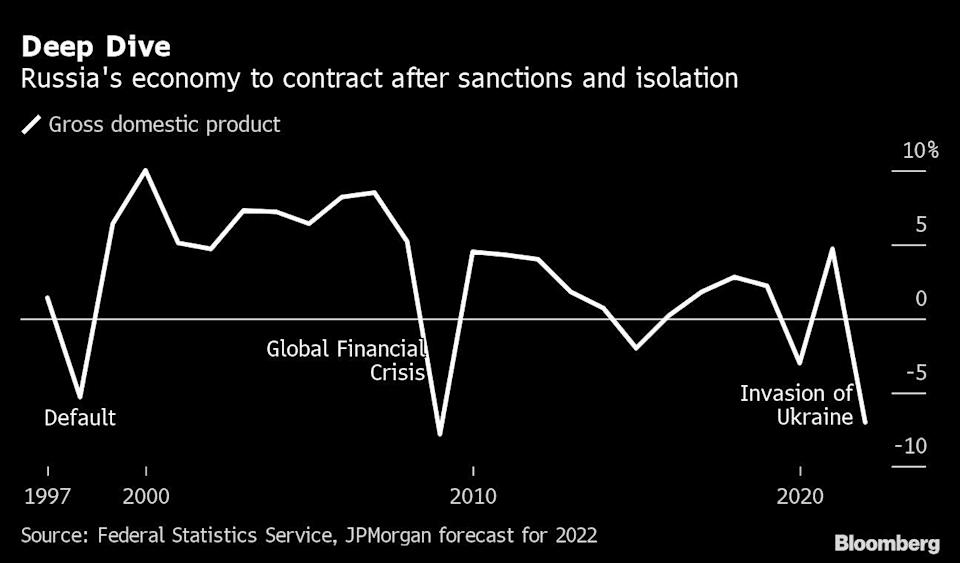

JPMorgan economists said in a note to clients that a “peak-to-trough” decline in Russian gross domestic product of about 11% is now expected, “in line with the drop seen in the 1998 debt crisis.” Sanctions on the central bank, along with SWIFT global messaging system outageaccording to JPMorgan, created obstacles to Russia’s ability to sell oil and gas.

“Russian export earnings will take a hit and capital outflows are likely to be immediate despite the huge current account surplus,” they said. “Imports and GDP will collapse.”

President Vladimir Putin’s invasion of Ukraine It sparked uncertainty in global oil markets, as buyers shy away from doing business with Russia as the United States and others seek to isolate it from financial markets. Traders are offering the main Russian crude at a record discount in an attempt to attract buyers.

You may also like:

hit hard on the ruble

in the meantime, Unprecedented restrictions on the Bank of Russia have limited its ability to defend the ruble, which has already fallen more than 30% against the dollar this year. Instead, policymakers more than doubled the interest rate to 20% and tightened capital controls.

“Negative pressure on the ruble and capital flight are prompting the Russian Central Bank to sharply raise interest rates and impose capital controls,” analysts at JP Morgan said. “Sanctions undermine the two pillars of stability: the protection that derives from the central bank’s foreign exchange reserves and Russia’s current account surplus.”

Oil and gas revenues have provided a lifeline for Russia’s hard currency because energy and transportation sales have largely escaped outright disruption. Russia had a monthly current account surplus of about $20 billion at the beginning of the year.

The Biden administration remains opposed to banning oil imports from Russia, though its objections put the administration in conflict with bipartisan demands to punish Moscow for the invasion of Ukraine.

JPMorgan now expects the Russian economy to contract by 7% this year, down from its previous forecast of a 3.5% decline. It expects a 10% decline this quarter on a seasonally adjusted annual basis, followed by a 35% decline in the following three months.

Analysts said that “the sanctions will negatively affect the Russian economy, which now appears to be heading into a deep recession.”

You may also be interested in | Video: Keys to understanding the sanctions imposed by the West on Moscow

//

original note:

JPMorgan warns that Russia is heading for a “collapse” in the economy in 1998

More stories like this are available at bloomberg.com

© Bloomberg LP 2022

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/O7LBHPJG55N2I367YYQHU5U3MA.jpg)